Number of people aged 65 and over, by age group in selected years 1900–2010. Note: Data for 2020–2050 are projections of the population. Reference population: These data refer to the resident population.

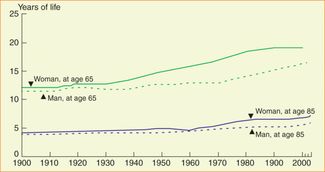

Life expectancy

In the United States, improvements in health over the past century have resulted in increased life expectancy and contributed to the growth of the older population. As shown in Figure 53.2, Americans are living longer than ever before. Life expectancies at both age 65 and 85 years have increased. Current life expectancy is approximately 86 years for women and 78 years for men. Under current mortality conditions, men who survive to age 65 can expect to live an average of 17 years and for women, the life expectancy at 65 is currently 20 years. The life expectancy of people who survive to age 85 today is 6 years for men and 7.2 years for women. The further one progresses beyond age 65 years, the longer one is expected to live. Although life expectancies have improved dramatically over the last decade in the United States, individual life expectancies vary based on existing comorbidities, quality of life, race, and socioeconomic status.[10, 11]

Life expectancy at ages 65 and 85 years, by gender, in selected years 1900–2009. Reference population: These data refer to the resident population.

Life expectancy at age 65 in the United States is lower than that of many other industrialized nations. The longest life expectancies are for Japanese women. Within the United States, the longest life expectancies are in Hawaii. This is due to the influence of a larger proportion of ethnic Japanese. Life expectancy also varies by race, but the differences change with age. In the United States, life expectancy at birth and at age 65 is higher for white people than for black people. At older ages, however, the life expectancy among black people is slightly higher than among white people. This has been attributed to a “healthy survivor” effect, more social support, and other factors. Not surprisingly, differences in life conditions of older persons with inadequate income and those above the median income in the United States have led to the conclusion that there is a major discrepancy of one to two-and-a-half years in active life expectancy between the poor and the nonpoor.[10, 11]

Active life expectancy

The concept of active life expectancy is useful in thinking about functional status and independence in older adulthood. In life expectancy, the end point is death. In active life expectancy we are also concerned with the loss of independence or the need to rely on others for assistance with daily activities. Simplistically put, the remaining years of life for a group of persons can be “active” or “dependent,” or some combination thereof. Active life expectancy answers the question “Of the remaining years of life for this cohort of persons, what proportion is expected to be spent with little or no disability?” The answer has implications for individuals, families, and societies. As one oft-quoted line states, “And in the end, it’s not the years in your life that count. It’s the life in your years.”

The impact of death rate on society

The impact of an aging population on death rates and the subsequent broad social impact illustrate the complex consequences of an aging society. Currently, three-fourths of all deaths in the United States occur among those aged 65 years and older. Consequently, the overall number of deaths per year is expected to increase as the population increases in age. A predictable consequence will be an increased demand across the spectrum of health-care services for the quality and quantity of end-of-life care. It can also be expected that the new demand for end-of-life care services will require increases in specific health-care education for multiple disciplines, the number of individual and organizational providers, and the financing of this health-care service. The broader social impact is less predictable. More deaths may increase demand for the number and types of funeral services. Growth in funeral services will require a commensurate growth in the mortuary sciences as well as an increased demand for land for cemeteries. An additional social impact could be in greater tension over land use and zoning in certain municipalities and neighborhoods. This is just one instance in which the effects of an aging society will have broad, and not always predictable, effects on our local, regional, national, and global communities.[2–4, 6–8, 12–18]

Crossing the street

Among the myriad changes of normal aging are a decrease in stride length and a consequent reduction in gait speed. That is, older pedestrians walk slower. Studies of ambulatory community-dwelling elderly individuals have found that the time allotted at a crossing signal (i.e., how long the “walk” sign remains illuminated) is inadequate to allow many older adult pedestrians to cross the street before traffic resumes, thus creating a potentially serious safety hazard. The obvious solution to accommodate an increasingly older populace and promote functional independence is to change the timing of the traffic lights to allow more time for crossing the street. Changing the timing of traffic lights, however, has an obvious slowing effect on traffic flow. Any change in traffic flow also has a significant effect on safety, as well as the economy. In fact, controlling and linking traffic signals across large metropolitan areas has been a primary means by which an increase in cars has been accommodated over several decades without building new roads. In some areas, even changing a single traffic signal can have a major effect. Thus, a number of difficult choices confront society in the coming years as the older adult population grows. This is but one example of the unintended social consequences of one decision to accommodate the needs of an increasing number of older adults; others may not be as obvious as changing a stoplight.[19–21]

Consumer spending, work, and the economy

Our economy has undergone tremendous change over the last few decades for a multitude of reasons such as new technology, globalization, and a shift from manufacturing to service sector jobs. Although these changes have little to do with population aging, the increasing age of a population has dramatic effects on the economy. As the population ages, the labor market changes: it becomes older and decreases in size. It is likely that the retirement age will increase for many people, particularly professionals. Similarly, it is likely that the service sector will continue to grow, particularly in health care, financial services, travel, and generally in the professions. The kind of work that older workers desire and are able to do, particularly those who remain in the workforce beyond retirement age, is different from the kind of work done by young people just entering the work force. In particular, the transition of jobs to more service and less production includes less reliance on physical strength, making it possible for older workers in those areas to stay employed longer. This shift in the available workforce will have a tremendous economic impact.[3, 8, 17, 22]

Consumer spending is also largely dependent on the age of consumers. The demand for goods and services will change as the needs and preferences of consumers change with age. A shift in consumer spending may have far-reaching economic impacts. For example, trade deficits with other nations may continue to rise as a result of our shifting national economy. There will also be relative shortages in the number and expertise of our labor pool. Labor shortages of this nature will result in upward wage pressure and outsourcing. Additionally, government spending on health care and retirement benefits will significantly affect government priorities, tax policy, the federal debt burden, and the government’s ability to impact the economy through public policy. It is quite possible that the size of the overall economy could shrink, if the numbers and types of workers decrease without significant increases in individual productivity.[1–3, 5, 8, 13, 22–25]

Housing

The housing needs and preferences of seniors are different from younger homeowners. After retirement, many people opt to downsize to a smaller home or apartment to access home equity, to reduce the time and expense of housekeeping and maintenance, to accommodate disabling medical conditions, or to relocate to another community. If a large number of people in a particular real estate market were to make similar decisions at the same time, real estate prices would be expected to change. Regardless of such an abrupt market change, it is likely that demand will change significantly over a long period of time, resulting in changing prices and supply. Increasingly, newer homes are built incorporating the principles of “universal design,” or architectural features to accommodate lifelong aging as well as the occurrence of disability. Because retrofitting (involving redesign and construction on) older homes is expensive, this has been a welcome change in home design; however, affordable housing is currently in short supply in many communities, regardless of age. Affordable housing that is also accessible for adults with disabilities is in even shorter supply. Moreover, affordable housing coupled with assistance for activities of daily living (i.e., assisted-living facilities) for low-income older adults is nonexistent in many communities.

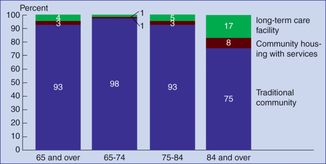

The default for many poor older adults who require even limited assistance with activities of daily living is long-term nursing facility placement because Medicaid pays for it. Figure 53.3 shows the increasing reliance on long-term care facilities to provide a residence for older adults who require assistance with their activities of daily living. Although only 1.5% of all individuals aged 65–74 live in long-term care, this rises to nearly 25% for those older than 85. While the absolute numbers of people living in long-term care facilities is declining slowly, the level of disability of residents is significantly increasing. These older adults often enter long-term care facilities on a short-term basis following acute care hospitalization. They cannot, however, be discharged to the community, despite clinical improvement, because their care needs cannot be affordably met elsewhere. To avoid the demand for significant increases in nursing facility construction in the future, there must be much greater availability of affordable housing with services for older adults who require assistance with their activities of daily living. This will likely require the concerted cooperation between government at all levels and the private sector.[2–9]

Percentage of Medicare enrollees aged 65 and over residing in selected residential settings, by age group, 2010. Note: Community housing with services applies to respondents who reported they lived in retirement communities or apartments, senior citizen housing, continuing care retirement facilities, assisted-living facilities, staged living communities, board-and-care facilities/homes, and other similar situations, and who reported they had access to one or more of the following services through their place of residence: meal preparation, cleaning or housekeeping services, laundry services, help with medications. Respondents were asked about access to these services but not whether they actually used the services. A residence is considered a long-term care facility if it is certified by Medicare or Medicaid; or it has three or more beds and is licensed as a nursing home or other long-term care facility and provides at least one personal care service, or provides 24-hour, 7-days-a-week supervision by a caregiver. Reference population: These data refer to Medicare enrollees.

Changes in government policies

If government does indeed serve the people, then the role, size, scope, and priorities of government will surely change as an aging society’s needs change. Just as older consumers have different preferences and needs, so do older voters, and the adult children who serve as caregivers for older family members. Attitudes toward taxation and spending priorities vary by age. As already evidenced in our society, an older voter on a fixed income may be both particularly concerned about paying increasing taxes and about any threatened cuts to government programs from which they benefit. Younger voters may likewise be concerned about shouldering an even bigger burden of higher taxes to support retirement programs, particularly if they do not trust that those same programs will be available for them in the future. Additionally, funding for schools and roads compete with funding for health care and housing for older adults. To the extent that families have become smaller and geographically separated, many more older adults need to rely on all levels of government to meet their basic needs of health, nutrition, safety, and security.[3–5, 9, 23, 25–27]

Federal and state entitlement programs

A large and growing proportion of federal government spending goes to the large-scale entitlement programs that provide a variety of essential benefits to older adults – namely Social Security, Medicare, and Medicaid. As the number of Americans aged 65 and older increases, the cost of each of these programs also increases. Meanwhile, the proportion of younger Americans aged 65 and younger contributing to these three programs through payroll taxes is decreasing. Additionally, the amount of money paid out in benefits has grown faster than overall tax revenues or the economy has grown. Consequently, these programs represent an increasing percentage of the federal budget, and an increasing percentage of the national gross domestic product. Each of these three programs will now be discussed in greater detail.

Social Security

When the Social Security program was developed in the 1930s, the population of the United States was much younger, and life expectancy was much shorter. Relatively few people were expected to live long enough to collect any retirement benefits, and even fewer retirees would live to collect benefits for many years. In addition, for every one person collecting retirement benefits, there were more than 20 younger, working Americans paying into the system through payroll taxes. Subsequently, life expectancy has increased by more than 15 years, and the number of retirees has dramatically increased. In 1960, there were only five workers paying Social Security taxes for every Social Security beneficiary. Currently there are a little more than three workers for every beneficiary. By 2020, the number will be reduced to fewer than three workers, and by 2040 to just two workers. In the next half century, barring any changes to taxes or benefits, the Social Security Trust Fund will be depleted.[2, 3, 8]

To prevent or forestall future insolvency of the Social Security program, a variety of proposals to raise the minimum retirement age, reduce benefits, and/or raise payroll taxes have been debated. Others have proposed partially or completely privatizing Social Security. It should be noted, however, that Social Security income represents a large proportion of overall income for most retirees. Consequently, any reduction in benefits or any threat to the stability of the program is expected to have a major and broad societal impact.[2, 3, 6, 8, 22]

Medicare

Medicare is the health-care insurance program for Americans aged 65 and older and for the disabled. The Medicare program was developed to provide insurance coverage for seniors in response to what many economists termed a “market failure.” That is, prior to Medicare’s inception in the 1960s, many older Americans with chronic illnesses found themselves uninsurable in the private insurance market, despite their ability to pay insurance premiums. Consequently, Medicare was developed as a program for all older adults, regardless of income or wealth. Despite concerns about the inefficiency of the large bureaucracy of the federal government, Medicare is very efficiently run compared with most private insurance companies, virtually all of which spend a substantially larger proportion of premiums on overhead compared with Medicare. In addition, Medicare has controlled costs better than the private sector. Consequently, the rate of increase in health-care inflation has been much lower over the last two decades within the Medicare program when compared with the private sector. Because Medicare is very effective in controlling costs, projections about large increases in overall program costs (with the exception of Medicare Part D drug coverage) have been related more to the growth in the number of beneficiaries resulting from population aging rather than to runaway health-care costs. One way in which Medicare has effectively controlled spending has been to reduce and limit payments to hospitals, physicians, and other health-care providers. In recent years, however, many private insurers reduced payments or eligibility for covered services even further, such that hospitals generally regard Medicare as a reliable, if not preferred payer.[13, 24, 25, 28, 29]

Changes implemented by Medicare since the late 1980s, such as the Diagnosis-related Group Prospective Payment System for hospitals have fundamentally changed health-care delivery in this country, resulting in reduced hospital duration-of-stay patterns, a shift of care away from hospital settings, and tremendous growth in home health care and skilled nursing facility utilization. How much Medicare pays for a given service in a given site of care affects access to care, the location where care is provided, and even health-care quality. Moreover, although Medicare has sometimes taken its lead from the private sector, such as in offering managed care coverage, private insurance coverage for patients of all ages is also affected by coverage decisions made by Medicare. In many respects, Medicare has served as a model that private insurers have subsequently followed. Medicare also pays to train resident physicians at teaching hospitals throughout the nation. As a result, any changes made to Medicare have the potential to affect health-care delivery for everyone. As the largest of the federal entitlement programs, and with significant programmatic cost increases projected, an increase in revenues through taxation, premium increases, copayment increases, or a reduction in benefits is inevitable.[25, 28–30]

The Medicare Part D drug coverage program has extended prescription drug coverage to many and has partially privatized the Medicare program for others. The federal laws that created this program also restricted the ability of Medicare administrators to control costs by specifically prohibiting price controls on prescription drugs. Due to these restrictions, there is little doubt that the cost of the Medicare program will increase dramatically in the coming decades. The impact and fate of the Medicare Part D prescription drug program in the future are more uncertain. Some sources predict that the Medicare Part D prescription drug program will threaten the integrity of the entire Medicare program.[25, 28–30]

In addition to the impact of population aging on Medicare, the future of this program will also be affected substantially if coverage is extended to younger Americans. Extending Medicare eligibility or offering Medicare-style benefits to the working uninsured is one of many ideas that has been suggested by legislators, policy makers, business leaders, and others under the Affordable Care Act to deal with the dual crises of uninsurance affecting more than 41 million Americans, most of whom work, as well as a crisis in the current employee-sponsored insurance system, which is insufficient to provide coverage to tens of millions of uninsured working Americans. The employee-sponsored insurance system is expensive and burdensome to employers, adds to the cost of goods and services produced in this country, and is consequently seen as a threat to economic competitiveness in the global marketplace. American producers are competing with producers from other nations, virtually all of which have some sort of government-sponsored universal health-care coverage.[23, 24, 28, 31]

Stay updated, free articles. Join our Telegram channel

Full access? Get Clinical Tree