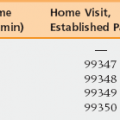

9 Knowing Payer, Benefits, Medicare Contractor, Specialty/Licensure, and Group Rules Claims, Claims Edits, and Modifiers Evaluation and Management Services Documentation Guidelines and Current Procedural Terminology (CPT) Definitions Charges and Charging for all Services Performed Working As a Team—”Incident to,” Shared Visits, and Teaching Charging the Patient or Family Global Periods and Per-Day Services Payment Modifications (eRx, PQRS, Primary Care Bonus, and Meaningful Use) and Migration Away from Fee for Service Upon completion of this chapter, the reader will be able to: • Understand the relevant coding systems for billing: ICD, CPT, HCPCS Level II. • Understand that coding and billing rules may vary based on benefits and payer. • Understand the structure of evaluation and management codes in CPT and the Centers for Medicare and Medicaid Services (CMS) documentation guidelines. There are three key coding systems. The first is the diagnostic classification system known as International Classification of Diseases, Clinical Modification (commonly called ICD-9). This system will be replaced in the United States with ICD-10 on October 1, 2014. The World Health Organization creates ICD versions, but the clinical modifications are from the U.S. National Center for Health Statistics; thus ICD-CM versions do vary by country. ICD also includes ICD-PCS, a procedural code set. Hospitals use ICD-PCS for inpatient procedure coding but professionals use the American Medical Association’s Current Procedural Terminology (CPT) and the Centers for Medicare and Medicaid’s Healthcare Common Procedure Coding System, Level II (known as HCPCS). Hospitals also use CPT and HCPCS for outpatient procedure reporting. All sections are relevant to professionals and it is important to gain familiarity with the range of codes. For example, although a bladder volume scan is not technically imaging and is certainly not surgery it is in the urodynamics subsection of CPT, which is within the surgery/urinary system section. If a code for a common service cannot be located, one should not conclude that a code does not exist; it is more likely that it simply has not been found yet. However, there are some important exceptions. For example, removing sutures that were placed by a clinician from another practice would be considered E/M; there is no suture removal code. A mental status exam is part of E/M, and not in the neuropsychologic testing sections. HCPCS codes are used for drugs administered, such as a steroid injection. Medicare also uses HCPCS codes for specific benefits. For example, a flu shot administration has CPT codes, but Medicare requires that HCPCS G code G0008 is reported. This is because the CPT administration code is agnostic to the vaccine given and not all vaccines are covered by Medicare (outside of a Medicare Part D drug benefit). It is strongly advised that all medical professionals maintain access to current editions of these coding resources. CPT changes annually and HCPCS changes quarterly.

Billing and coding

Coding systems

Oncohema Key

Fastest Oncology & Hematology Insight Engine